By Rocco A. Carriero

By Rocco A. Carriero

Having spent decades saving for retirement, it can feel like a major shift for retirees to transition to spending down their hard-earned assets. Retirees can be reluctant to dip into their principal for fear of running out of money, the anticipation of increased healthcare expenses and other factors.

However, there are a few key tips to help get you started. First, don’t spend it all in one place. Retirees usually spend most of their savings in the first few years after leaving a job because of the excitement around all that newfound leisure time. Make sure to pace yourself—and your spending—so that it lasts as long as you do.

Second, it is important to take the long view on health care, which will be your largest expense, so it is crucial to have a strategy to cover those needs. Options will include a combination of Medicare, Medigap supplemental insurance, health savings accounts (HSAs), long-term care policies, continuing health insurance through your current or former employer and other dedicated health care savings.

Another tip is to minimize your risk. As you turn your investments into income, it’s important to assess your level of risk to avoid disruptions in your income. Ensure you have a diversified portfolio that suits your anticipated spending and balances your needs for liquidity and growth. For example, consider having a year to several years of easily accessible investments to provide income in case of a market downturn or an unexpected financial event in your life. At the same time, it’s important to also have investments that are positioned for growth.

When the time comes, withdraw wisely, as a well-crafted retirement income plan can help you avoid running out of money and feel more confident about what could be decades spent in retirement. If your assets include a mix of Social Security, annuities, retirement assets and other investment earnings, decide which you will tap into first. Remember that at 70 and a half years of age, you are mandated to take required minimum distributions from your traditional IRA and employer-sponsored retirement plans, so work this income into your plan.

It also doesn’t hurt to work with someone who knows what they are doing, like a tax advisor. Reducing the tax bill on retirement income must be a priority for retirees. Yet research shows 53 percent of retirees feel it is too complex. Starting the planning process early and seeking guidance from a tax and financial advisor can help.

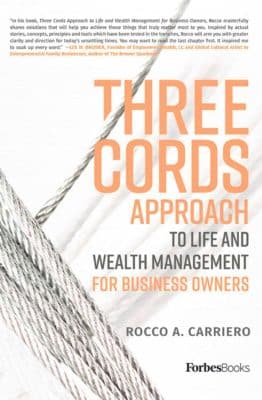

Rocco A. Carriero is a private wealth advisor and the author of Three Cords Approach to Life and Wealth Management for Business Owners, published with ForbesBooks, a book publishing imprint of Forbes Media.

Rocco A. Carriero is a private wealth advisor and the author of Three Cords Approach to Life and Wealth Management for Business Owners, published with ForbesBooks, a book publishing imprint of Forbes Media.